after tax income calculator iowa

This marginal tax rate means that your immediate additional income will be taxed at this rate. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

Iowa Income Tax Calculator Smartasset

Your average tax rate is 222 and your marginal tax rate is 361.

. - FICA Social Security and Medicare. Iowa Income Tax Calculator 2021 If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. After a few seconds you will be provided with a full breakdown of the tax you are paying.

United States Italy France Spain United Kingdom Poland Czech Republic Hungary. State Tax is a progressive tax in addition to the federal income tax. The tax is imposed at a fixed or graduated rate on taxable income.

Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. The above calculator assumes you are not married and you have no dependants so the standard deduction per annum is 12950 USD. Taxable Income in Iowa is calculated by subtracting your tax deductions from your gross income.

This income tax calculator can help estimate your average income tax rate and your salary after tax. To calculate the Iowa Earned Income Tax Credit multiply your federal EITC by 15 15. Taxable Income in Iowa is calculated by subtracting your tax deductions from your gross income.

Your average tax rate is 1882 and your marginal tax. While this calculator can be used for Iowa tax calculations by using the drop down menu provided you are able to change it to a different State. Total state income tax paid.

If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. It can also be used to help fill steps 3 and 4 of a W-4 form. Compound Interest Calculator Present Value Calculator.

For instance an increase of 100 in your salary will be taxed 3613 hence your net. After entering it into the calculator it will perform the following calculations. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

This calculator is intended for use by US. Iowa Income Tax Calculator 2021 If you make 103000 a year living in the region of Iowa USA you will be taxed 22322. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Filing 12500000 of earnings will result in 2100900 of that amount being taxed as federal tax. Fields notated with are required. This results in roughly 84113 of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on.

How many income tax brackets are there in Iowa. Iowa residents are subject to personal income tax. Calculate your net income after taxes in Iowa.

In addition to federal income tax collected by the United States most individual US. Your average tax rate is 1527 and your marginal tax. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

That means that your net pay will be 43309 per year or 3609 per month. The state income tax rates range from. The Iowa salary paycheck calculator will calculate the amount of Iowa state income taxes that are withheld from each paycheck.

The federal income tax has seven tax brackets which range from 10 to 37. If you make 55000 a year living in the region of Iowa USA you will be taxed 11691. Although this is the case keep in mind.

The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37 depending on your income. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax liability minus any additional tax withholdings Total annual income Tax liability All deductions Withholdings Your annual paycheck State payroll tax. Total Tax Paid Net Annual Salary Net Monthly Salary Net Weekly Salary 63652.

This is equal to a percentage of Iowa taxes paid with rates ranging from 0 to 20. Your average tax rate is 1198 and your marginal tax rate is 22. This marginal tax rate means that your immediate additional income will be taxed at this rate.

How Income Taxes Are Calculated. The state income tax rates range from 0 to 65 and the sales tax rate is 6. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Our Iowa State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 12000000 and go towards tax. - Iowa State Tax. Filing 12500000 of earnings will result in 956250 being taxed for FICA purposes.

Far too many people fail to allow for the full income tax deduction allowances when completing their annual tax return inIowa the net effect for those individuals is a higher state income tax bill in Iowa and a higher Federal tax bill. Iowa Income Tax Calculator 2021 If you make 173500 a year living in the region of Iowa USA you will be taxed 47267. Your household income location filing status and number of personal exemptions.

After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax. Your average tax rate is 213 and your marginal tax rate is 349. The rate ranges from 033 on the low end to 853 on the high end.

Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return inIowa the net effect for those individuals is a higher state income tax bill in Iowa and a higher Federal tax bill. So for example if your Iowa tax liability is 1000 and your school district surtax is 15 you would pay an additional 150. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

There are nine different income tax brackets in the Iowa tax system. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Filing 25000000 of earnings will result in 1420374 of your earnings being taxed as state tax calculation based on 2022 Iowa State Tax Tables.

Iowa Resources Iowa calculators Iowa tax rates Iowa withholding forms More payroll resources. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Team Genus Asset Allocation Corporate Bonds Investing Strategy Investment Portfolio

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Ann Notated How Others Handle Income Tax Filing Organization Filing Taxes Income Tax Income

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

1 500 After Tax Us Breakdown June 2022 Incomeaftertax Com

Tax Withholding For Pensions And Social Security Sensible Money

How To Easily Track Travel Expenses And More Dang Travelers Track Travels Travel Preparation Travel Prep

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain What Is Capital

![]()

Iowa Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

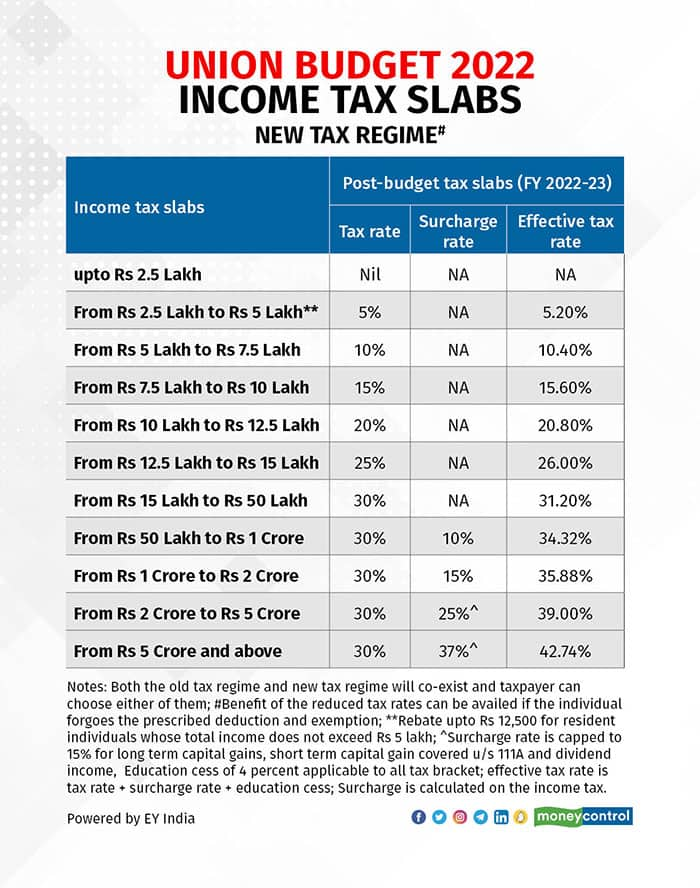

How To Choose Between The New And Old Income Tax Regimes

Georgia Retirement Tax Friendliness Retirement Calculator Financial Advisors Retirement

Income Tax Calculator 2021 2022 Estimate Return Refund

What To Do When The Irs Is After You Irs Personal Finance Lessons Earn More Money

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Paycheck

Income Tax Calculator Estimate Your Refund In Seconds For Free

Should You Move To A State With No Income Tax Forbes Advisor

How Much Should I Set Aside For Taxes 1099

Lili S Tax Resources Tools And Tips To Simplify Tax Season Lili Banking